Leading underwriter of Sustainable Bonds

Sustainable acting and managing are founding principles and part of the Cooperative DNA

Corporate Responsibility has a long tradition at cooperative banks. Accordingly, at DZ BANK, as central institution of the cooperative network, sustainability is anchored in our DNA. Sustainable Finance is therefore an essential part of our core business. With our Sustainable Financing products, we take into account environmental, social and ethical criteria and thus specifically promote the sustainable development of our society and the responsible use of limited resources.

Accordingly, we at DZ BANK have a team within our Capital Markets division that is dedicated to Sustainable Finance. For many years, the bank's DCM team has been actively contributing to the further development of the market for Sustainable Finance as a reliable partner for issuers. This was done, among other things through innovations such as ESGlocate (an innovative allocation tool for issuers of Sustainable Bonds) or the KPI Library (a tool for the rapid identification of possible KPIs for Target-Linked structures). Our ESG experts provide issuers with holistic support in the context of a Sustainable Finance Transaction, i.e. in structuring, placement and reporting. In addition to our activities in the primary market, we also develop and shape the topic of Sustainable Finance in numerous national (e.g. Forum Nachhaltige Geldanlagen (FNG), Green and Sustainable Finance Cluster Germany (GSFCG), Sustainable Finance Advisory Board of the German Federal Government) and international (Climate Bonds Initiative, ICMA Green Bond Principles, UN PRB) initiatives and working groups.

Save the date – DZ BANK Sustainability Day 2022

DZ BANK Spotlight: Sustainable Bond Market Outlook 2022

.jpg/jcr%3Acontent/renditions/original.transform/resize1920/image.jpg)

The Sustainable Bond Market in 2022: „Transition is key!“

Since the birth of the Green Bond segment in 2007, the Sustainable Bond market, with its many colours and facets, has already made a positive contribution to support financing the global sustainability agenda.

Without a doubt, Green Bonds were a good start for funding environmentally sustainable activities. However, the race to reach net zero emissions by 2050 requires all sectors to make their contribution. Hence, many issuers in those sectors have to completely rethink their business models. Some of them will find decarbonisation easy. Others face major challenges and still have to figure out the how and the when. That is perfectly fine. Rome wasn’t built in a day. It is not possible to become net zero overnight. The journey of a thousand miles begins with the first step. Moving in the right direction will involve a transition period.

Hence, banks, whose role is increasingly changing from a traditional financial intermediary to a sustainable finance intermediary, need to become a reliable partner for transition candidates who express their credible transformation ambitions through the fixed income market for example.

In line with the new credo "transform instead of divest", the transformation of the real economy is also finding its way into the investment strategies of more and more investors. In the past, a large number of sustainable investors focused on strategies such as exclusions or best-in-class approaches. Those companies that did not fit into the grid were sold. Today, investors are increasingly interested in the transformation potential of the real economy. Identifying the "sustainable companies of tomorrow" is becoming more and more important.

An increasing number of fixed income investors is discovering - in their role as key stakeholders - the possibility of engagement with promising transformation candidates. While they do not have voting rights, they can enter into an active dialogue with the management of the companies being transformed, either on their own or through joint collaboration with other investors. Through this active engagement, they can encourage companies to be more transparent in their disclosure of ESG factors, better manage material sustainability risks, and follow a proper and credible transformation path.

The option to divest always remains - but only as ultimo ratio if, for example, a company abandons the promised, credible transformation path.

Therefore, transition financing will become one of the most important elements in the Sustainable Bond market in the coming years.

But first, let's take a look back at the Sustainable Bond market in 2021.

2021: New records in the Green Bond segment

Without doubt, 2021 was another exciting year for the Sustainable Bond market, which just missed the USD 1trn mark.

After a conciliatory end to a COVID-19 plagued 2020, Green Bonds set new records in 2021. With a new issuance volume of almost USD 75bn, September was the most successful month to date since the birth of the Green Bond segment. Furthermore, a new giant has emerged in the market, as the European Union will raise up to 30% of the NextGenerationEU funds through the issuance of NextGenerationEU Green Bonds. With the maiden issue of EUR 12bn in October, the world's largest Green Bond to date saw the light of day. Overall, the new issuance volume in the Green Bond segment amounted to USD 500bn and hence more than 85% above the previous year's level.

In addition, Social Bonds and Sustainability Bonds continued to enjoy tailwinds in 2021. While the new issuance volume of the former increased by slightly more than 30% to USD 185bn, the latter showed the highest growth rate in the entire Sustainable Bond market with more than 140% rising to USD 165bn. This underlines the trend "Green goes rainbow", reflecting the ongoing diversification in the Sustainable Bond market.

The segment “Transition and Target-Linked Financing”, which includes Transition Bonds as well as Target-Linked Bonds, also showed impressive growth of more than 120% to around USD 100bn. In our opinion, this segment will receive special attention in the future, as we can only successfully implement the global sustainability agenda if we "get everyone on board", i.e. also issuers from critical sectors with business activities whose journey on the transformation path will still be a longer one.

2022: All segments continue to move in the right direction

We forecast growth in all segments of the Sustainable Bond market in 2022.

We expect the new issuance volume in the Green Bond segment to increase by 50% to USD 750bn. The segment is thus increasingly moving towards the USD 1trn mark, which we estimate will be exceeded in the course of 2023.

In the Social Bond segment and in the Sustainability Bond segment, we forecast a new issuance volume of USD 200bn each, corresponding to growth rates of 8% and 21%, respectively.

Due to the increasing importance of transition financing, the segment “Transition and Target Linked Financing”, which includes Transition Bonds and Target-Linked Bonds, is expected to grow the most. Here we forecast a 60% increase in new issuance volume to USD 160bn.

Overall, the Sustainable Bond market will therefore exceed the USD 1trn mark in the course of 2022 reaching a new issuance volume of around USD 1.3trn.

Stay up to date on Sustainable Finance

Did you miss an issue? In our archive you will find all the previous editions of the Bulletin

Our initiative for the markets of tomorrow

The Sustainable Finance market is characterised by innovations, both in structural and technical terms. With our innovation projects "ESGlocate" and "KPI Library", we at DZ BANK contribute to the further development and standardisation of the market and offer our customers innovative solutions for specific challenges within the issuance process. In doing so, we set new standards in the market with our ideas for solutions for both structuring (KPI Library) and placement (ESGlocate).

More and more issuers are using the option of a sustainability-focused allocation process as they are interested in putting a sustainable exclamation mark at the end of the value chain of a Sustainable Bond transaction. ESGlocate is an innovative, data-based ESG scoring tool used by investors in the context of Sustainable Bond transactions.

DZ BANK has recognised the dynamics in the Sustainable Finance Market and launched the DZ BANK KPI Library, an innovative project for issuers of so-called Target-Linked structures. Based on the economic sectors in which the issuer is active, the KPI Library provides a list of possible key performance indicators (KPIs) that could underlie such a transaction. The guidelines of the ICMA Sustainability-Linked Bond Principles, the Sustainable Development Goals of the United Nations and the EU Taxonomy, among others, serve as orientation.

Your added value

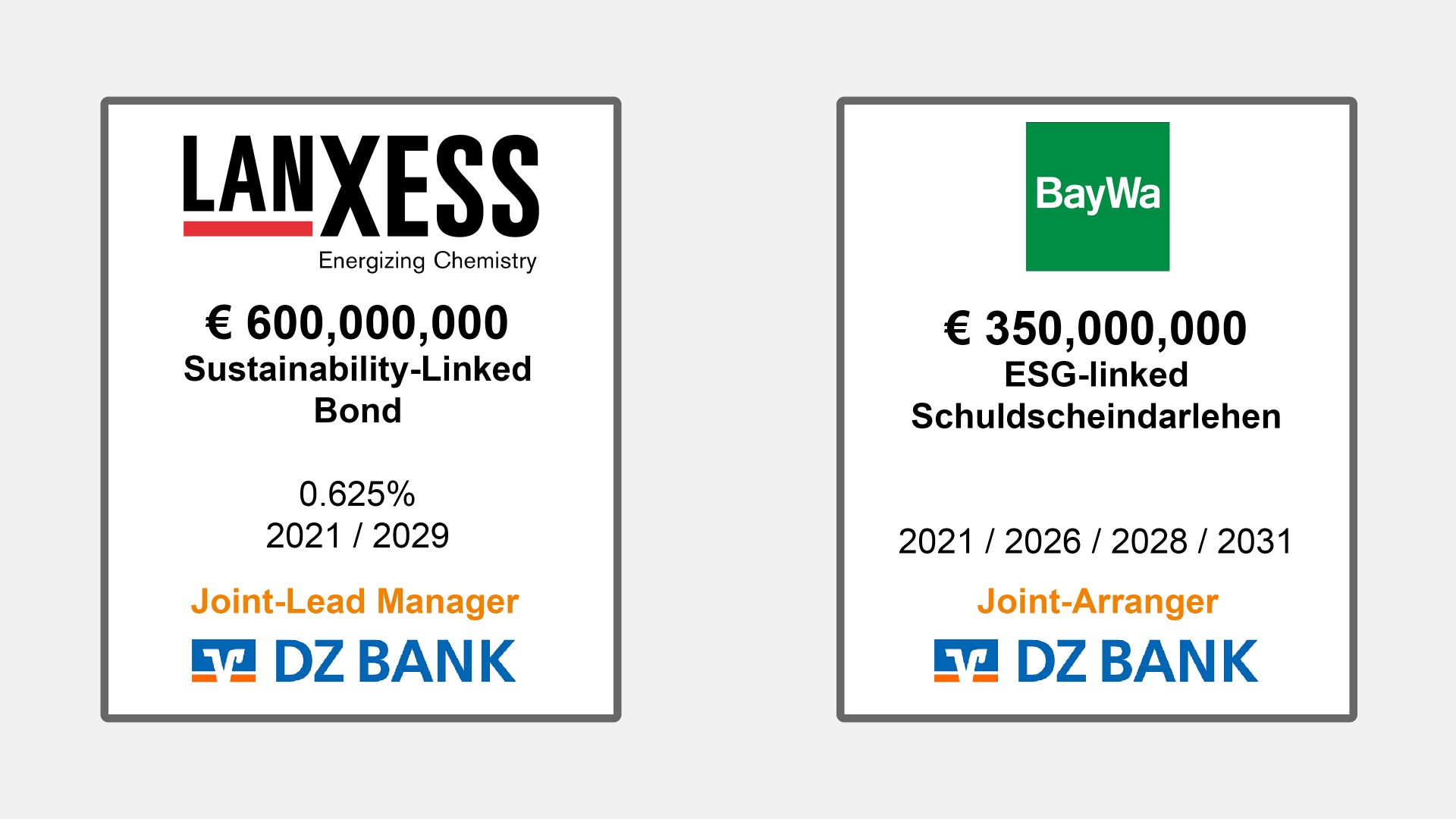

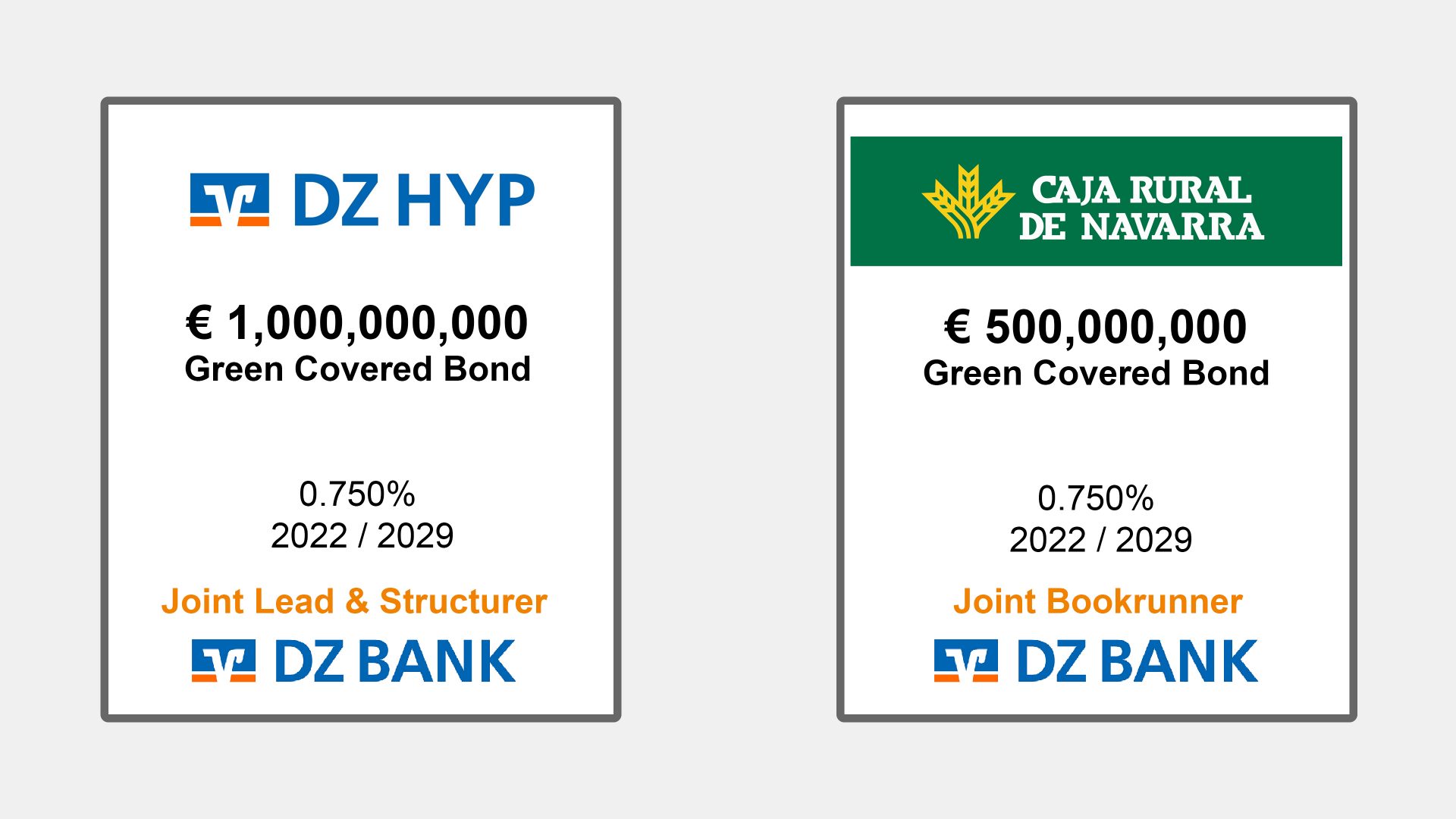

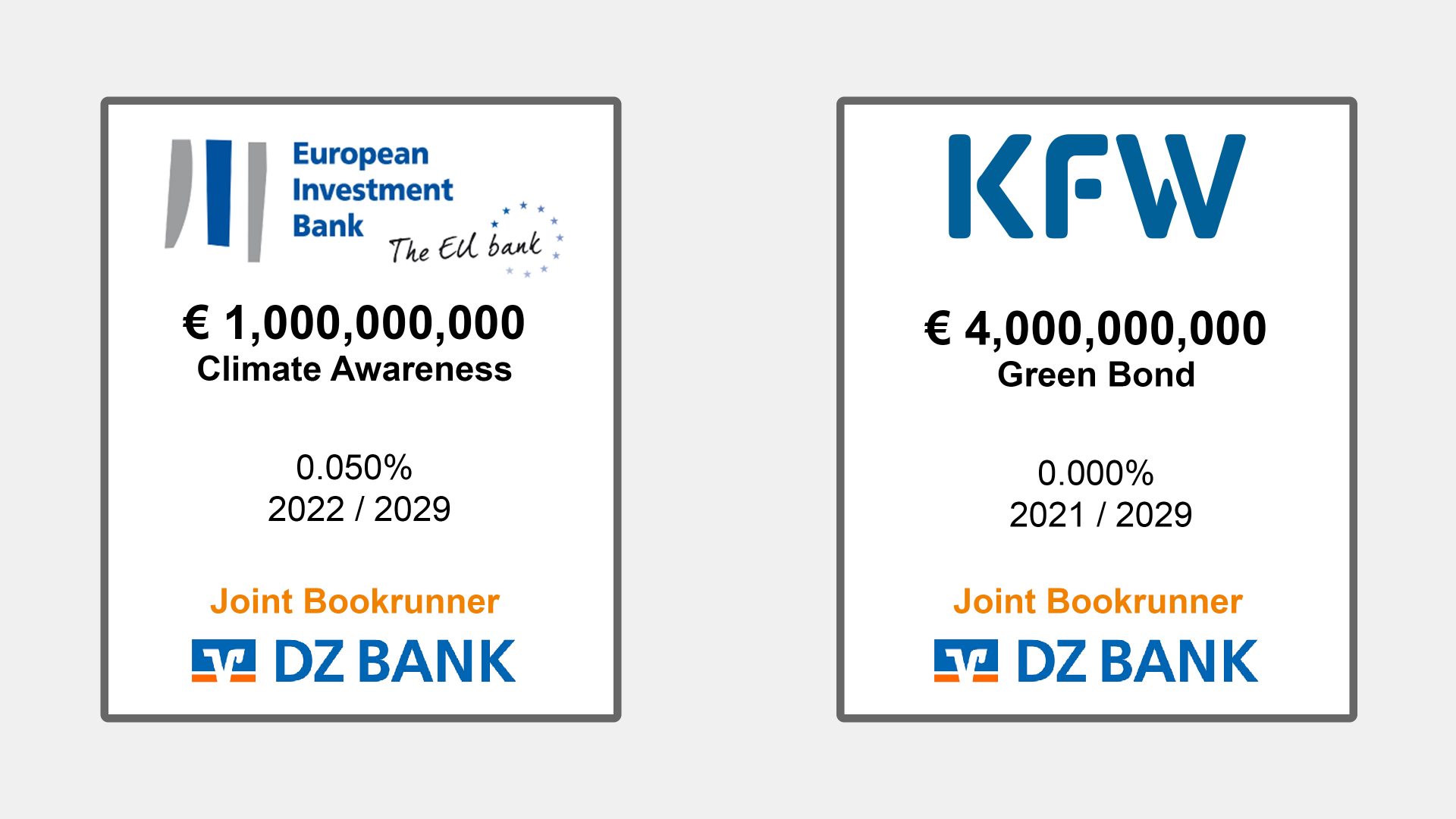

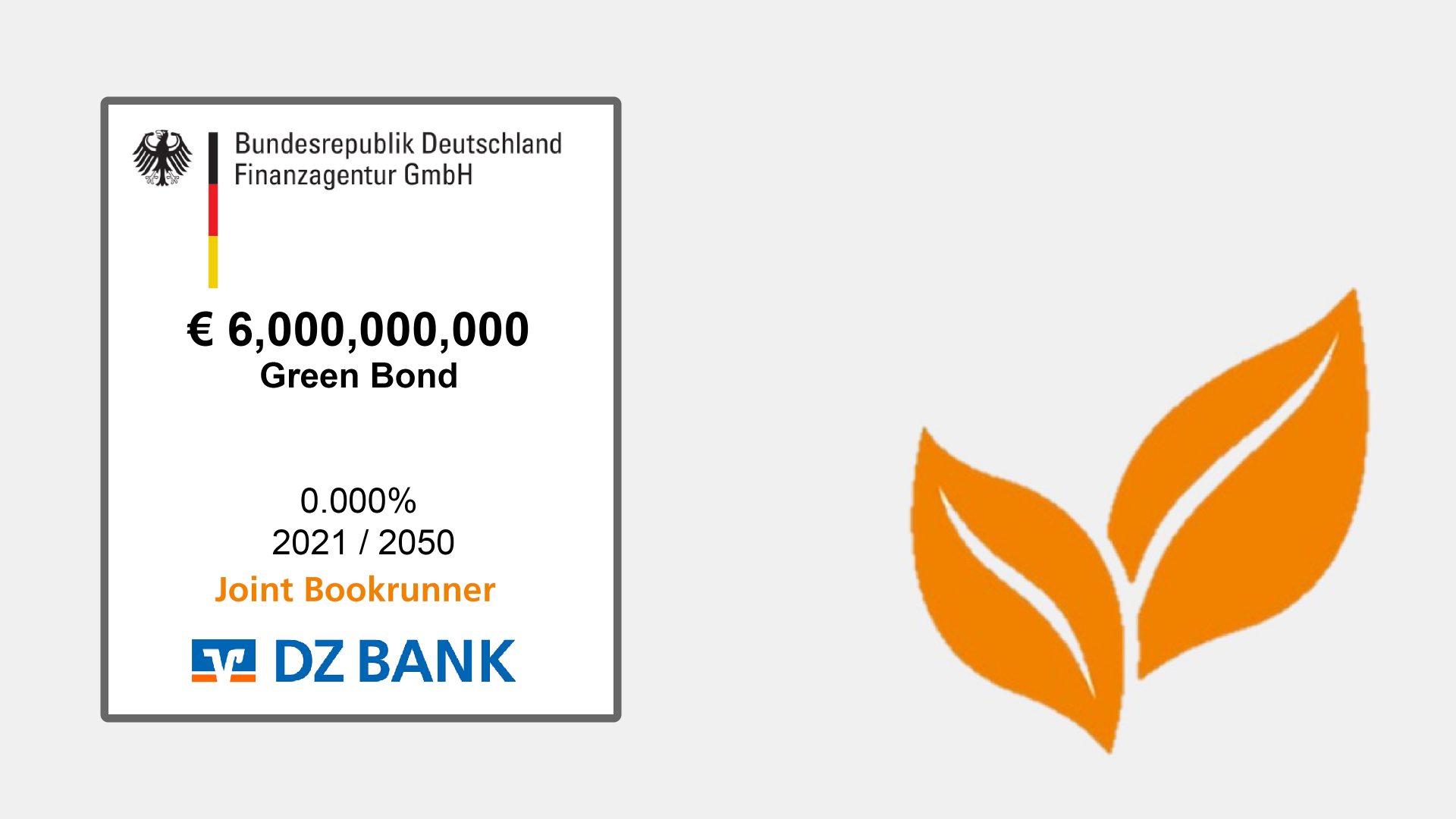

Support for numerous inaugural transactions as well as transactions of regular issuers. In 2021: 33 Green, Social and Sustainability Bond transactions of more than EUR 52 billion for SSAs, FIGs and Corporates as issuers as well as several Sustainability-Linked Schuldscheindarlehen

One of the most established bookrunner track records among German banks since 2007. DZ BANK is one of the leading European dealer banks in its core market for Sustainable Bond transactions (Green, Social, Sustainability and Sustainability-Linked Bonds).

DZ BANK-USP: Sustainable Investment Research with a unique EESG analysis and rating methodology; strong relationships with SRI investors in the cooperative network and beyond.

DZ BANK as an innovator in the ESG market: ESGlocate – sustainability-focused allocation of Sustainable Bonds; KPI Library - comprehensive KPI database for issuers of Target-Linked transactions.

Regular Sustainable Finance publications on structural background, market developments in the Sustainable Bond segment and the regulatory environment as well as upcoming events.

Further development of the Sustainable Finance market: DZ BANK is involved in numerous national and international initiatives and working groups to strengthen and further develop the market for Sustainable Finance.

Successful placements for ESG issuers